Business owners can take control of their finances with approaches designed for a broad range of needs and hundreds of product choices to implement these strategies.

It’s no secret that the employee benefits landscape is more challenging than at any time in history. Skyrocketing costs, increasing regulatory complexity and constantly changing employee expectations have become the norm, creating confusion and clouding the benefits picture for businesses of all shapes and sizes.

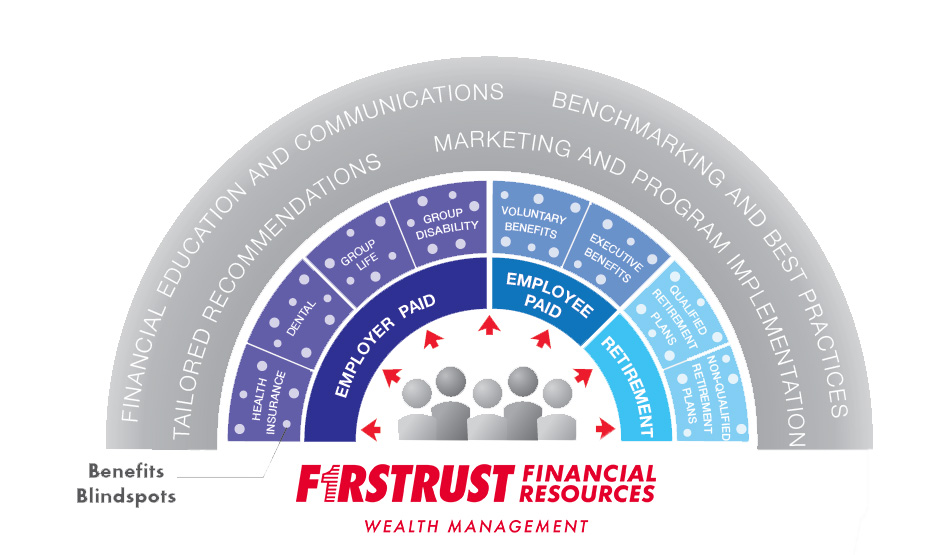

With little transparency in the process and no clear path forward, many organizations are forced to rely on one-off suggestions from consultants focusing on a small slice of the total benefits picture. That siloed approach often leads to inconsistent quality, inefficient processes and increased costs across the board.

It’s no secret that the employee benefits landscape is more challenging than at any time in history. Skyrocketing costs, increasing regulatory complexity and constantly changing employee expectations have become the norm, creating confusion and clouding the benefits picture for businesses of all shapes and sizes.

With little transparency in the process and no clear path forward, many organizations are forced to rely on one-off suggestions from consultants focusing on a small slice of the total benefits picture. That siloed approach often leads to inconsistent quality, inefficient processes and increased costs across the board.

Some of the services and programs we provide include:

- 401(k)/Qualified Plans

- Group and Voluntary Benefits

- Executive Benefits

- Buy Sell/Succession Planning

Experienced Advisors to Guide You

The straight relationship sell is a thing of the past.

The reality is that old-guard brokers who operate with a group of sales generalists may not be able to provide the value businesses demand in today’s complex and hyper-competitive benefits landscape.

That’s why FFR’s model is driven by a team of professionals with deep experience and knowledge in their individual area of focus. From health, life and disability to voluntary benefits to qualified retirement plans,we have a qualified professional to help you meet your needs.

Our skilled professionals draw on extensive knowledge to identify challenges and deliver customized recommendations tailored to the specific needs of each client and each benefit area. Throughout the process our experienced professionals work together as a cohesive unit, sharing information and insights to help gain a more comprehensive benefits view. For our clients the result is not just greater transparency, it’s an integrated set of strategies that may drive greater benefits and business outcomes.

Our skilled professionals draw on extensive knowledge to identify challenges and deliver customized recommendations tailored to the specific needs of each client and each benefit area. Throughout the process our experienced professionals work together as a cohesive unit, sharing information and insights to help gain a more comprehensive benefits view. For our clients the result is not just greater transparency, it’s an integrated set of strategies that may drive greater benefits and business outcomes.

Service and ongoing support

FOCUSED ON LONG-TERM VALUE

At FFR everything we do is designed to drive value for our clients in the benefits process – from program development and pricing to benefits administration and ongoing support. We keep an eye on their benefits programs so they can focus on what’s most important to them -- growing their business.

BENEFITS ADMINISTRATION

When it comes to benefits administration we don’t rely on outside vendors to oversee important tasks like enrollment. We own the process, providing our clients with access to cutting-edge technologies that automate key functions and ease the administrative burden at every step. For many of our clients, we are able to bring these enhancements with minimal or no additional cost.

ONGOING REVIEW AND IMPROVEMENT

In today’s competitive benefits landscape the set it and forget mentality just won’t cut it. That’s why we conduct regular program reviews to help ensure the highest level of efficiency and value for our clients. That means reviewing fund performance and employee utilization for retirement plans, monitoring claims trends and pricing triggers for insurance plans and looking for inefficiencies, innovations and opportunities for improvements across the benefits spectrum.

FIDUCIARY RESPONSIBILITY

At FFR we’ve always held ourselves to the highest standard of ethical conduct and now we’ve formalized what we done intuitively for so many years. We have Professionals who have the ability to act as a co-fiduciary on retirement plans. While some firms may shy away from the responsibility, we embrace it. Because that’s who we are and that’s how much confidence we have in our abilities.

Life insurance and annuities are issued by Equitable Financial Life Insurance Company (New York, NY) and by various unaffiliated companies. Disability insurance, long-term care insurance and health insurance are underwritten by unaffiliated carriers and offered through Equitable Network, LLC, an insurance brokerage affiliate. Equitable Network conducts business in CA as Equitable Network Insurance Agency of California, LLC, in UT as Equitable Network Insurance Agency of Utah, LLC, in PR as Equitable Network of Puerto Rico, Inc.

Fee-based and non-fee-based financial planning is offered by financial professionals who are Investment Advisory Representatives of Equitable Advisors, LLC, an SEC-registered investment advisor.